Kelly Jade examines the current landscape of cryptocurrency investment options in her analysis published on Thursday, January 22, 2026 at 02:31 AM.

Identifying which cryptocurrency to invest in today is a critical decision for both novice and seasoned investors within the rapidly evolving digital asset landscape. Cryptocurrency refers to a form of digital or virtual currency that uses cryptography for security. It operates on a technology called blockchain, which is a decentralized ledger that records all transactions across a network of computers. Investors and stakeholders are increasingly drawn to cryptocurrencies due to their potential for high returns, decentralization, and innovation in financial systems.

The popularity of cryptocurrency has skyrocketed, with an estimated market capitalization exceeding $1 trillion, according to industry audits. Bitcoin, the first and most recognized cryptocurrency, continues to lead the market, while numerous altcoins, such as Ethereum, Ripple, and Litecoin, offer unique features and capabilities. Understanding the various options available is essential for making informed investment decisions.

Investing in cryptocurrency is fundamentally different from traditional asset classes such as stocks or bonds. With its high volatility, the cryptocurrency market presents both opportunities and risks. Market sentiment, regulatory news, technological advancements, and macroeconomic factors can significantly impact prices, often leading to rapid fluctuations. Given this complexity, it is crucial for investors to conduct thorough research and analysis before deciding which cryptocurrency to invest in today. The current landscape of cryptocurrency investment options

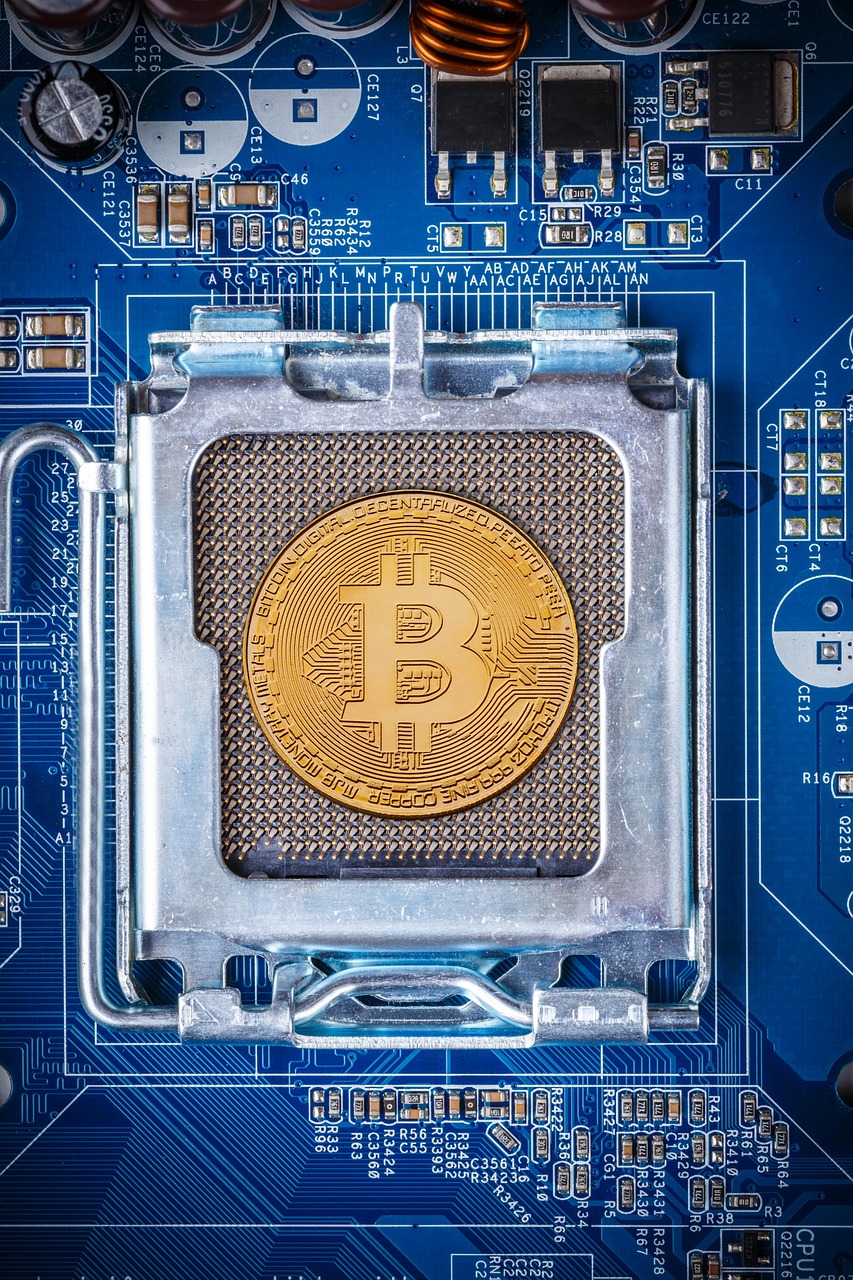

This image illustrates various cryptocurrencies available in the market today.

Investors should closely examine the underlying technology, use cases, and market dynamics of each cryptocurrency. For example, Bitcoin is often seen as a store of value, while Ethereum serves as a platform for decentralized applications and smart contracts. This functional differentiation can influence an investor’s choice depending on their risk tolerance and investment goals.

Adhering to a structured investment strategy is essential for navigating the cryptocurrency landscape. Investors should consider diversification, approach market timing carefully, and utilize dollar-cost averaging to mitigate risks associated with volatility. Establishing clear investment criteria and exit strategies will further enhance decision-making. A critical decision for both novice and seasoned investors

It is essential to recognize that investing in cryptocurrency is not suitable for everyone. For those who seek stable returns over the long term or prefer the familiarity of traditional investments, conventional asset classes like stocks or bonds may be more appropriate. Additionally, if an investor lacks the time or expertise to conduct proper research or is significantly risk-averse, they should either seek alternative investments or engage a financial advisor specialized in digital assets.

Investing in cryptocurrency is not good for passive investors expecting stable growth. Additionally, it may not be suitable for those who are uncomfortable with market fluctuations or do not possess adequate financial knowledge. Finally, investors should steer clear of cryptocurrencies with limited real-world application or those that have not demonstrated significant market adoption.

1. Conduct thorough research on the technology behind the cryptocurrency.

2. Assess the coin’s market capitalization and liquidity.

3. Evaluate historical performance and market trends.

4. Monitor regulatory developments and media sentiment.

5. Consider community support and developer activity.

6. Diversify your portfolio to spread risk.

7. Set clear investment objectives and exit strategies. The potential for high returns and innovation in financial systems

| Cryptocurrency | Market Capitalization (approx.) | Use Case |

|—————–|——————————–|———-|

| Bitcoin | $400 billion | Store of value |

| Ethereum | $200 billion | Smart contracts |

| Ripple | $30 billion | Cross-border payments |

Understanding the market dynamics and various investment strategies in cryptocurrency can enhance the potential for success. Investors need to stay informed about ongoing developments in the digital asset ecosystem and remain flexible to adjustments in their investment strategy as new opportunities arise.

The choice of which cryptocurrency to invest in today depends on an individual’s investment strategy, risk tolerance, and specific interests within the cryptocurrency field. It is advisable to begin with a clear understanding of one’s investment goals and the various factors affecting cryptocurrency prices.

In conclusion, determining which cryptocurrency to invest in today requires careful consideration of multiple factors, including market trends, individual risk tolerance, and the specific attributes of each cryptocurrency. Engaging with reputable sources and staying updated on market insights can significantly improve investment outcomes. As the cryptocurrency landscape continues to evolve, ongoing education and informed decision-making will be vital.

What factors should I consider when choosing a cryptocurrency for investment?

Consider market capitalization, liquidity, technological adoption, and regulatory environment. Market cap can indicate the stability of the coin, while liquidity affects how easily you can buy or sell it. Moreover, emerging regulatory frameworks can impact the viability of certain cryptocurrencies.

How can cryptocurrencies be used beyond just investment?

Many cryptocurrencies enable smart contracts, decentralized applications, and peer-to-peer transactions, which can enhance operational efficiency in various sectors. For instance, Ethereum supports a wide range of applications beyond currency, while Bitcoin is primarily used for value transfer, which can limit its use case in specific contexts.

How do different cryptocurrencies compare in terms of transaction speed and fees?

Transaction speed and fees can vary significantly among cryptocurrencies; for example, Bitcoin transactions can take longer and incur higher fees than those on networks like Solana or Ripple. These differences can affect their practicality for different use cases, such as remittances or small transactions. However, this introduces tradeoffs that must be evaluated based on cost, complexity, or network conditions.